Imagine this scenario: You’ve spent months negotiating a fantastic contract with a preferred supplier for office electronics. You secured a 20% discount, free shipping, and an extended warranty. You high-five your team and log the contract in your system.

Two weeks later, you walk past the marketing department and see five brand-new monitors—purchased at full retail price from a random online vendor using a corporate credit card.

That sinking feeling? That is maverick spend.

If you are a business owner or tasked with managing your company’s procurement process, you might think your biggest cost is the price of goods. In reality, your biggest cost is often the process itself—specifically, the lack of adherence to it.

In our 20+ years working in procurement, from small non-profits to large corporate boardrooms, We have seen maverick spend cripple cash flow and create compliance nightmares. But here is the good news: it is fixable.

In this guide, we will move you from scratching your head about where the money is going to having full visibility and control over your spend management.

What is Maverick Spend?

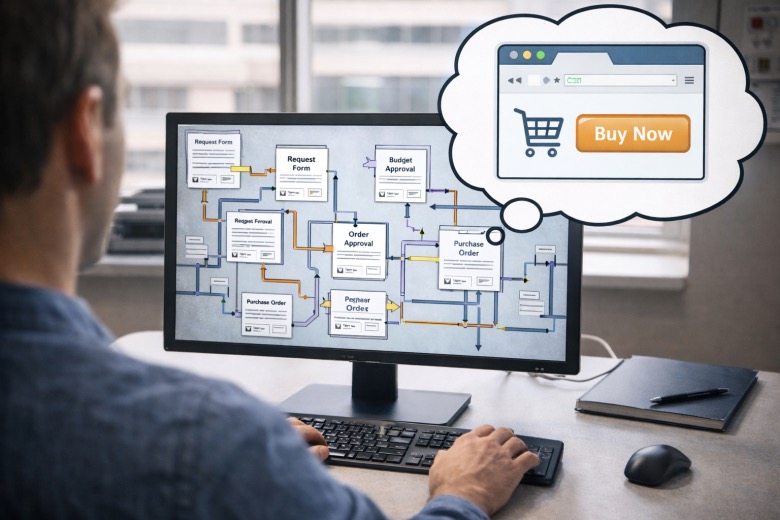

Maverick spend—often called “rogue spend” or “off-contract buying”—refers to purchases made by employees that bypass your organization’s established procurement policy.

It’s the purchasing equivalent of the Wild West. In fact, the term comes from Samuel Maverick, a 19th-century rancher who refused to brand his cattle. Today, it refers to unbranded, untracked, and unmanaged spending that wanders outside your control.

Image Source: AI Generated.

When an employee buys a laptop from a local store instead of your approved vendor, that is maverick spend. When a department head signs a SaaS contract without checking with IT or Finance, that is maverick spend.

It seems harmless in isolation—”I just needed it quickly!”—but when you multiply this behavior across an entire organization, the financial leakage is massive.

The Hidden Cost of "Going Rogue"

Why should you care if Bob from Accounting buys his own stapler? Because maverick spend is rarely just about staplers. It is a silent profit killer.

Industry research suggests that companies can lose between 10% to 20% of their negotiated savings due to maverick buying. If you negotiated a million dollars in contracts but 20% of your spend is rogue, you are leaving huge sums of money on the table.

This often occurs in what we call tail spend—the 80% of transactions that make up only 20% of your spend volume. Because these purchases are small and frequent, they fly under the radar. But death by a thousand cuts is still death.

Why Does Maverick Spend Happen?

Before you blame your employees, you need to understand why they go rogue. In my experience helping businesses optimize their operations, I’ve found that maverick spend is rarely an act of rebellion. It is usually an act of convenience.

1. The Process is Too Hard

If your official procurement process requires filling out a triplicate form, waiting three days for approval, and faxing a purchase order, your employees will find a workaround. If buying from Amazon takes two minutes and your process takes two days, Amazon wins every time.

2. Lack of Awareness

Do your employees know you have a contract with a specific stationery vendor? If you haven’t communicated your purchasing policy clearly, you can’t expect compliance. Often, people are simply not “problem aware.” They think they are helping by getting the job done fast, unaware they are hurting the bottom line.

3. Decentralized Spending

In many small to medium businesses, purchasing authority is scattered. The marketing team has a budget, IT has a budget, and Operations has a budget. Without a centralized system—a “single source of truth”—spending happens in silos.

The 3 Big Risks You Can’t Ignore

Maverick spend isn’t just an annoyance for the finance team; it creates tangible business risks.

1. Financial Loss

We’ve discussed the loss of negotiated discounts, but consider the processing costs. A “rogue” invoice often lacks a Purchase Order (PO). This forces your Accounts Payable team to chase down approvals manually. The cost of processing a single non-PO invoice is significantly higher than a compliant one.

2. Contract and Compliance Risk

When employees buy software or services off-contract, they often agree to Terms and Conditions that your legal team has never seen. This exposes your company to data breaches, unfavorable renewal terms, and liability issues. You might be paying for a vendor that doesn’t meet your ESG (Environmental, Social, and Governance) standards or insurance requirements.

3. Data Invisibility

You cannot manage what you cannot see. If 30% of your spend is happening on credit cards and expense reports, your spend analysis data is incomplete. This makes it impossible to forecast accurately or negotiate better contracts in the future because you don’t know your true volume.

How to Identify Maverick Spend in Your Business

So, how do you know if you have a maverick problem? You need to look at the data.

Start by reviewing your Accounts Payable ledger. Look for vendors that appear only once or twice. Look for invoices that don’t have a corresponding Purchase Order. Check your employee expense reports for items that should have gone through procurement, like software subscriptions or hardware.

If you find multiple vendors for the same category (e.g., five different travel agencies or three different toner suppliers), you have identified a maverick spend hotspot.

6 Ways to Manage and Manage Maverick Spend

Transitioning from chaos to control requires a mix of culture, process, and technology. Here are six strategies we recommend at Exceleris Consulting.

1. Analyze Your Spend Data

You need a baseline. Conduct a spend analysis to categorize where your money is going. Identify your top offenders and the categories most prone to rogue spending (usually marketing, IT, and office supplies).

2. Simplify the Buying Process

Make the right way the easy way. If your employees can buy from your approved suppliers as easily as they shop at home, they will do it. Reduce the friction in your approval workflows.

3. Centralize Your Contracts

Store all your negotiated contracts in one place. Ensure that everyone knows who the preferred suppliers are. If you have a Salesforce environment, this is a perfect place to house this data so it is visible to the sales and operations teams.

4. Educate Your Team

Don’t just issue a policy; explain the “why.” Tell your team that using the approved vendor saves the company money, which funds their bonuses or new equipment. Transform them from mavericks into partners.

5. Limit P-Card Usage

Corporate credit cards (P-Cards) are notorious vehicles for maverick spend. Set strict limits on card usage and review statements monthly. Ensure that cards are only used for true incidental expenses, not for procurement that should be on a PO.

6. Leverage Technology

This is the game-changer. You cannot manage modern procurement with spreadsheets and email. You need a system that enforces compliance automatically.

The Role of Technology: Turning Chaos into Control

At Exceleris, we believe in the power of orchestration. Managing procurement shouldn’t be a standalone burden; it should be integrated into your business operating system.

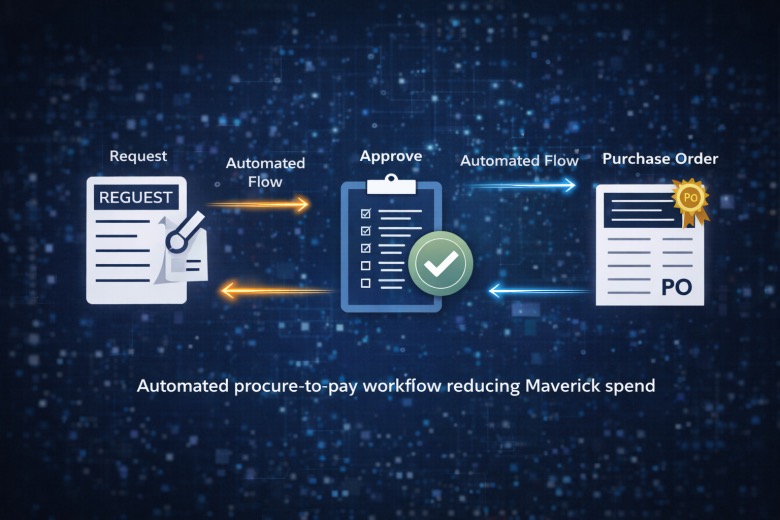

This is where platforms like Salesforce shine. By utilizing applications native to the Salesforce platform—such as Certinia (formerly FinancialForce), Rootstock, GoldFinch, AccountingSeed or our own XLRS Procurement Management—you can create a seamless Procure-to-Pay (P2P) process.

Imagine a world where an employee raises a requisition directly in the system they use every day. The system automatically checks the budget, routes it for approval based on rules you defined, and generates a Purchase Order to the correct vendor.

This provides:

- Visibility: Real-time dashboards of committed spend.

- Control: Hard stops on unapproved vendors.

- Efficiency: Automated three-way matching of the PO, the Receipt, and the Invoice.

When you use Google Cloud capability to orchestrate these workflows, you reduce the time it takes to get things done, removing the excuse for employees to “go rogue.”

From "Problem Unaware" to "Process Pro"

If you are reading this, you are no longer “problem unaware.” You now see that those random credit card charges are leaks in your ship. You understand that maverick spend is not just an accounting nuisance—it is a strategic weakness.

But you also know that it is solvable.

Managing the company’s procurement process is a journey. It starts with identifying the leak, and it ends with implementing a system that plugs it permanently. Whether you are a small business owner or a procurement manager in a large corporate entity, the principles remain the same: Visibility, Control, and Compliance.

Conclusion: Take Control of Your Procurement Process

You have worked hard to build your business. Don’t let maverick spend erode your margins. By implementing clear policies and supporting them with the right technology, you can turn procurement from a cost center into a value driver.

At Exceleris Consulting, we specialize in helping businesses like yours solve these exact problems. We use the power of Salesforce and complementary applications to orchestrate business success. We don’t just implement software; we help you design processes that work for your people.

Are you ready to stop the bleeding and start saving?

Download Our Exclusive Procurement Whitepaper

Ready to dive deeper? Download our comprehensive guide: “The SME Guide to Mastering Procurement: Stopping the Leak and Boosting the Bottom Line.”